What is a Syndicated Loan?

A syndicated loan, also known as a syndicated bank facility, is financing offered by a group of lenders – referred to as a syndicate – who work together to provide funds for a single borrower. The borrower can be a corporation, a large project, or sovereignty, such as a government. The loan can involve a fixed amount of funds, a credit line, or a combination of the two.

What is the size of the Syndicated Loans’ market?

- Global syndicated loans volume reached $5.28tr in 2018

- US-marketed loans volume totaled a record $2.92tr in 2018

- 2018 saw EMEA-marketed deals hitting $1.28tr

Issues in current process :

- It is a complex process with hundreds of borrowers and lenders for a single syndicated loan. The secondary market is even more complex.

- The existing loan syndication process between investors and customers is highly opaque.

- The cost of managing such loans is quite high.

- Fax, email, and telephone are predominantly used for communication.

- Till now there have been no agreed means to securely share data (along with the right access privileges) among the various parties, which makes the process manual and inefficient.

- Operational inefficiencies make reconciliation between the various parties extremely difficult and settlement takes significant time which blocks huge capital amounts.

- Very difficult to cope with regulations in various markets.

Syndicated Loan processing on Blockchain

All banks that work together to provide Syndicated Loans to their customers become part of a consortium blockchain. When a customer approaches a bank for a loan, that bank (aka Agent Bank) creates an offering on the blockchain that is visible to all participants. All interested banks negotiate the Loan terms with the Agent Bank which finalizes the syndicate. It obtains contractual agreements from all the syndicate members that are recorded/signed-off on the blockchain. The Loan is then disbursed to the customer as per the agreements and can be monitored through its lifecycle (which may extend over several years).

Banks such as Natwest, BNP Paribas, Natixis, and Societe Generale have already piloted FusionLenderComm, a Distributed Ledger Technology (DLT) platform for the syndicated loan market developed by Finastra in collaboration with R3.

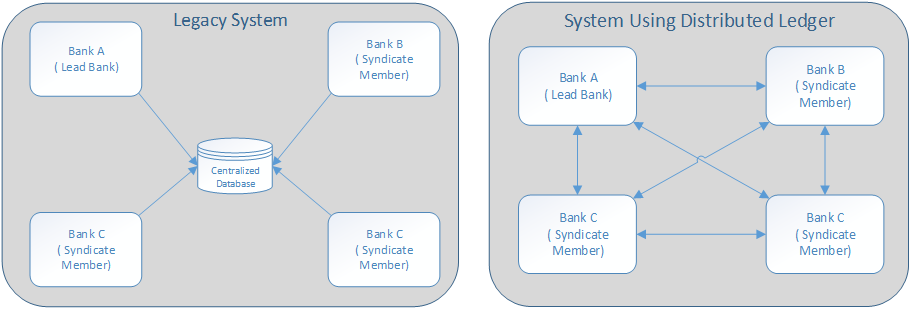

The comparison between the existing legacy system and the distributed ledger model is shown below :

The use of Blockchain ensures :

- Single source of truth as Syndicate details are visible to the Agent Bank and Syndicate members (as per permissions)

- No central authority to manage the application data, rather a data is shared using distributed ledger across the nodes. Although data privacy is achieved as selective details are shared with respective Loan Syndicate members.

- No need for manual exchanges of data through emails, faxes, etc.

- Reduction in transaction and record-keeping costs.

- Faster settlement times leading to lower risk and no capital hold up

- Easier audits and compliance. It provides a complete immutable transaction chain so that transaction history can be retrieved at any time. Secure, confidential and real-time information with no broken or missing pieces with an immutable history

Our Offering

We have created a solution that leverages the power of blockchain to enable a consortium of banks to create syndicated loans easily. When a large customer approaches a bank for a loan, that bank can use our application to advertise the loan in the marketplace, inviting other banks to participate in the syndicate. Other banks can then indicate their interest to participate in the syndicate. Once all bids are received, the Agent bank can review them and create the syndicate.

Summary

Blockchain makes the process of creating and managing Syndicated Loans a lot easier, secure, and reliable for all participants. It removes the need for a central authority, which in turn, reduces the operating cost drastically. It also ensures that no transactions are “lost” during the course of the loan – which may extend to multiple years.

External sources mentioned in the article: