Available designs:

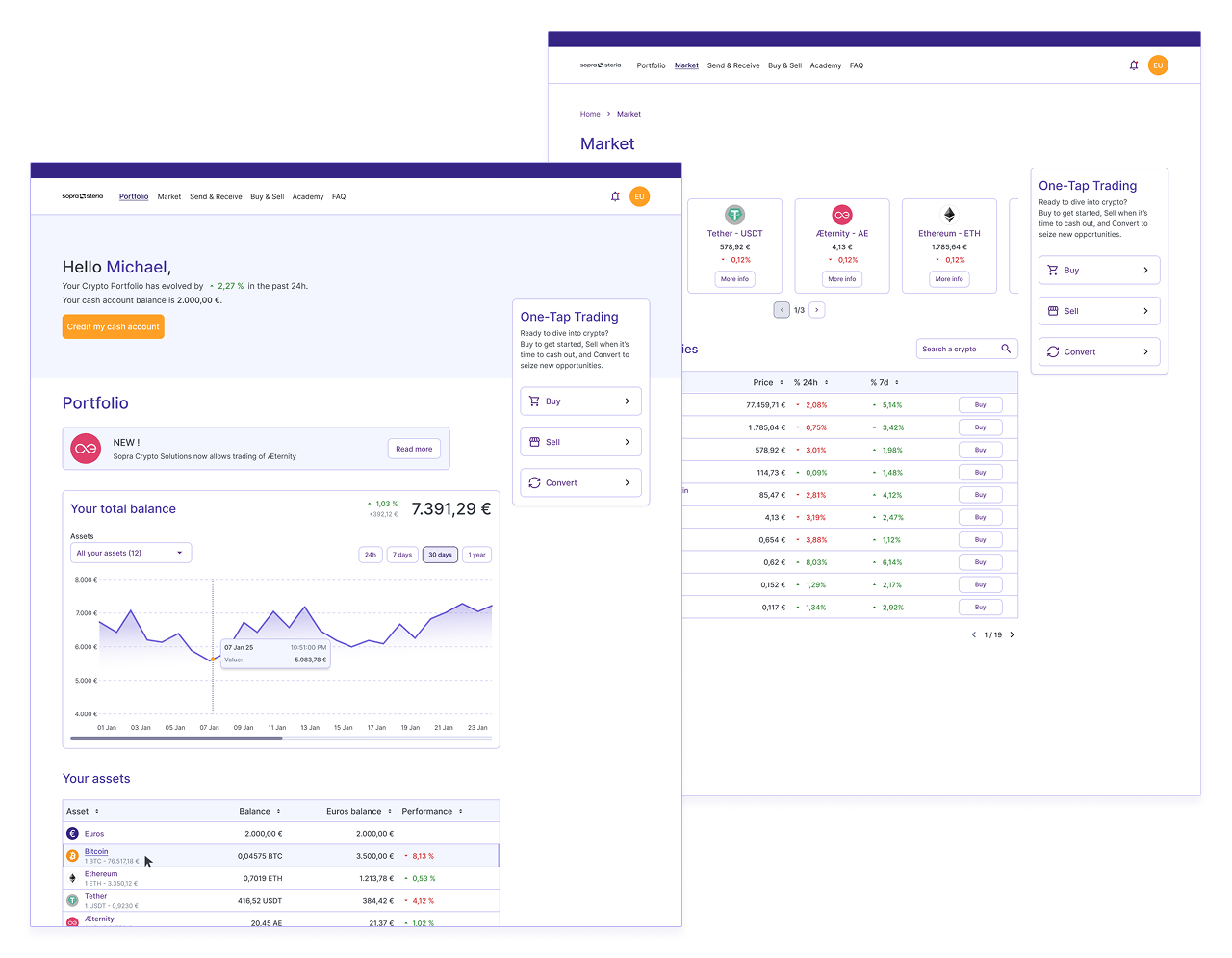

- Design publications list

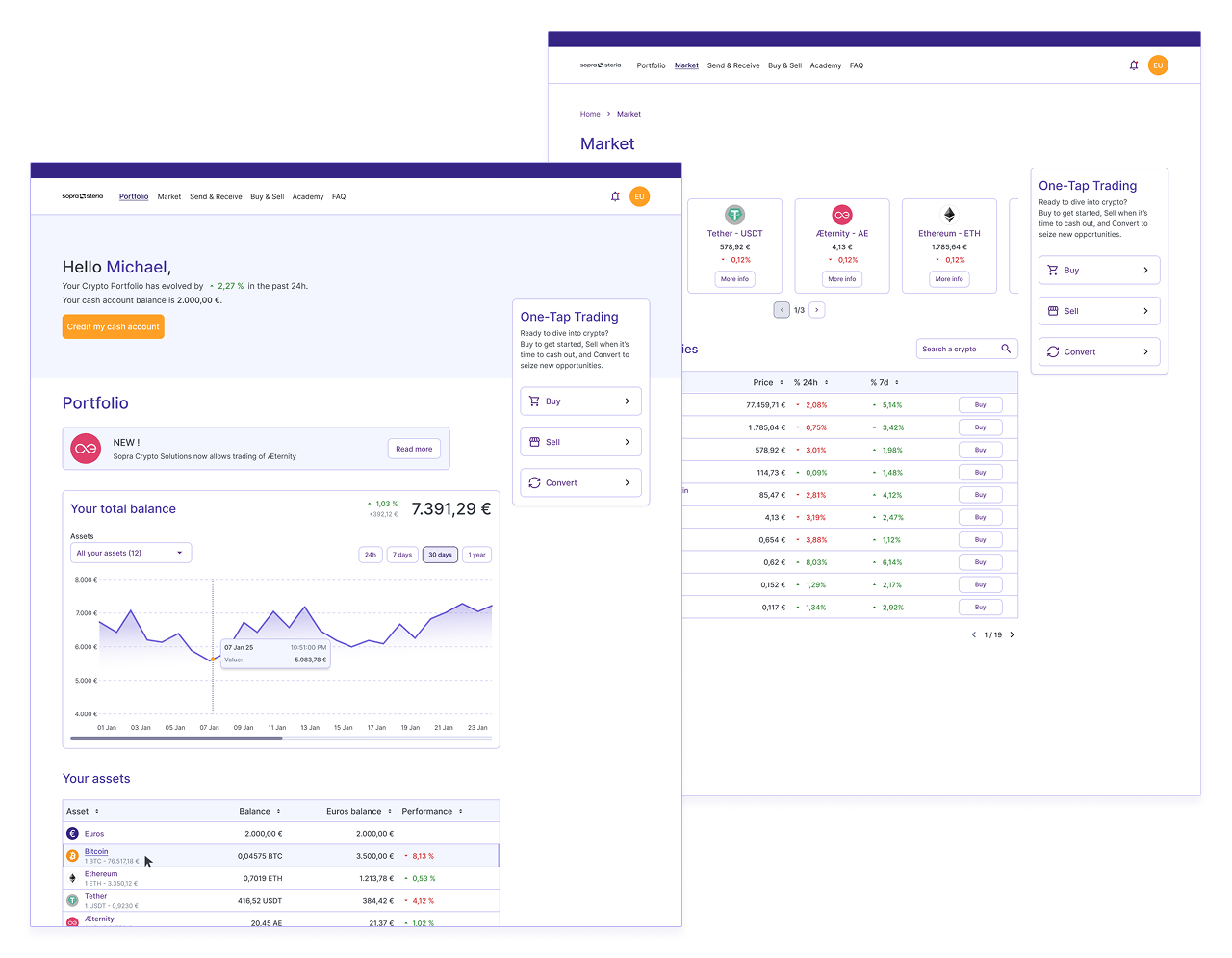

- Design list cards

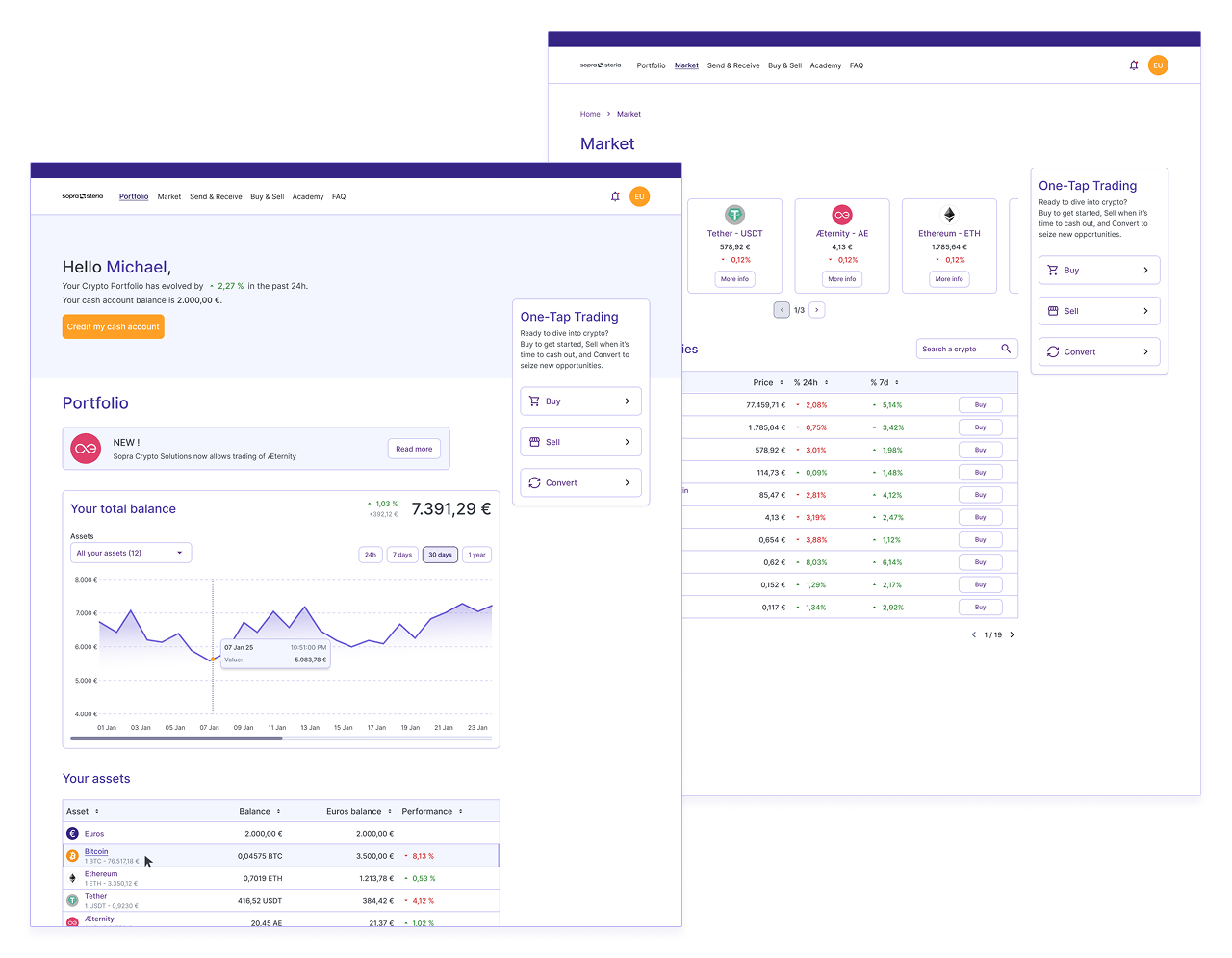

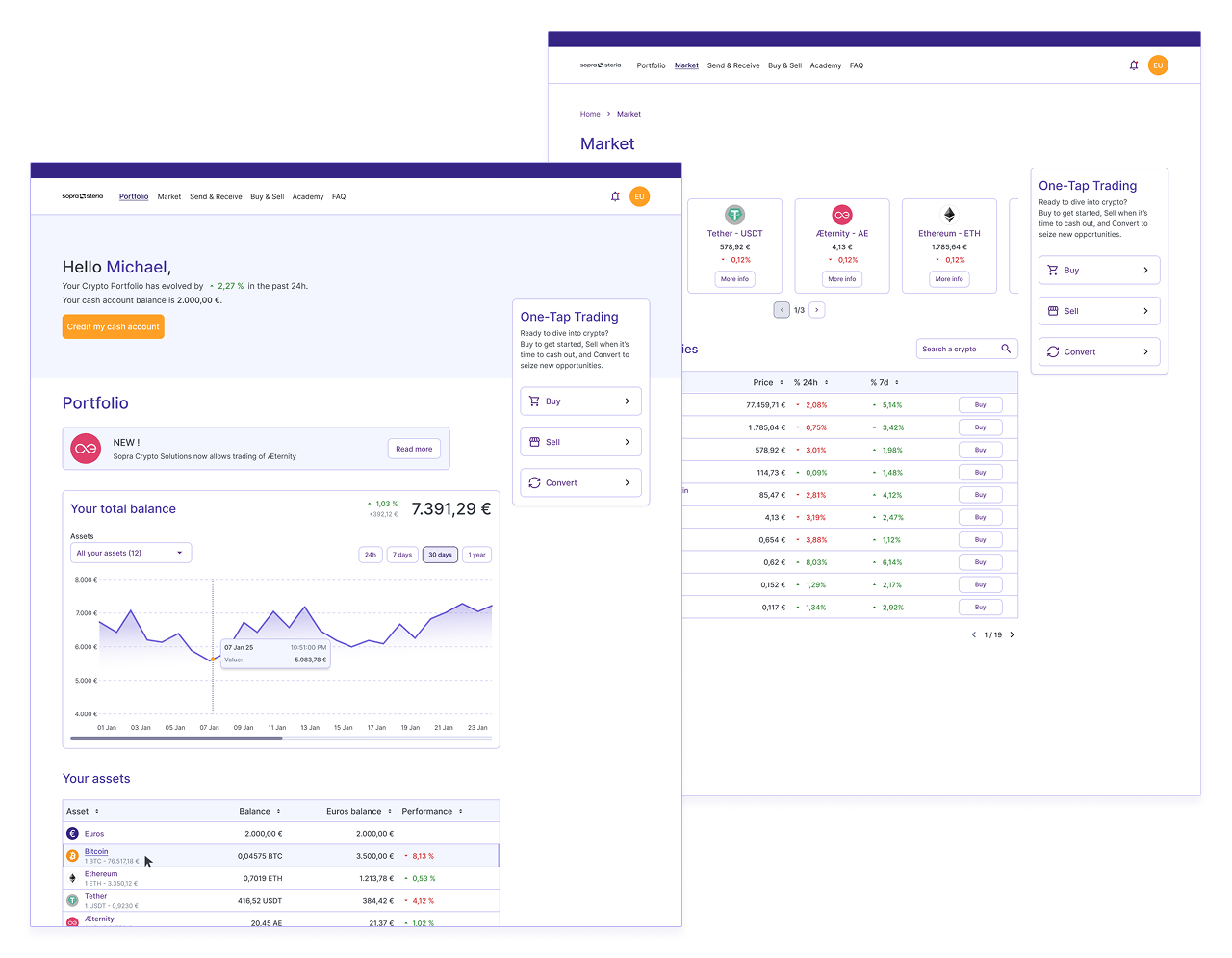

- Design list cards filtered

- Design block single article vertical

- Design horizontal imgLeft

- Design horizontal imgRight

- Design horizontal overlay imgLeft

- Design horizontal overlay imgRight

- Design vie du titre filtrage (CORP)

- Design informations reglementees filtered (CORP)

- Design detailed page

- Design detailed page PDF after form submit

- Design detailed page RH events

Please note:

- Banner image size: W1560 x H515 px

- Thumbnail image size: W440 x H325 px

- For good readability and design, keep almost same length of titles and abstract. This will keep the balance when having three elements in a row

- The Listen function (readspeaker) is removed from Detail pages

- Design widget analytics is used for analytics purposes by DSI

|

Abstracts: consistency, length and need

Users do not click to read the article if the abstract is long. Remember: 200 characters = 7 seconds to read.

Be consistent when using abstracts. If you have used abstracts only for some publications, you should make a choice: To have, or not

to have an abstract. If you use abstracts, please keep them short.

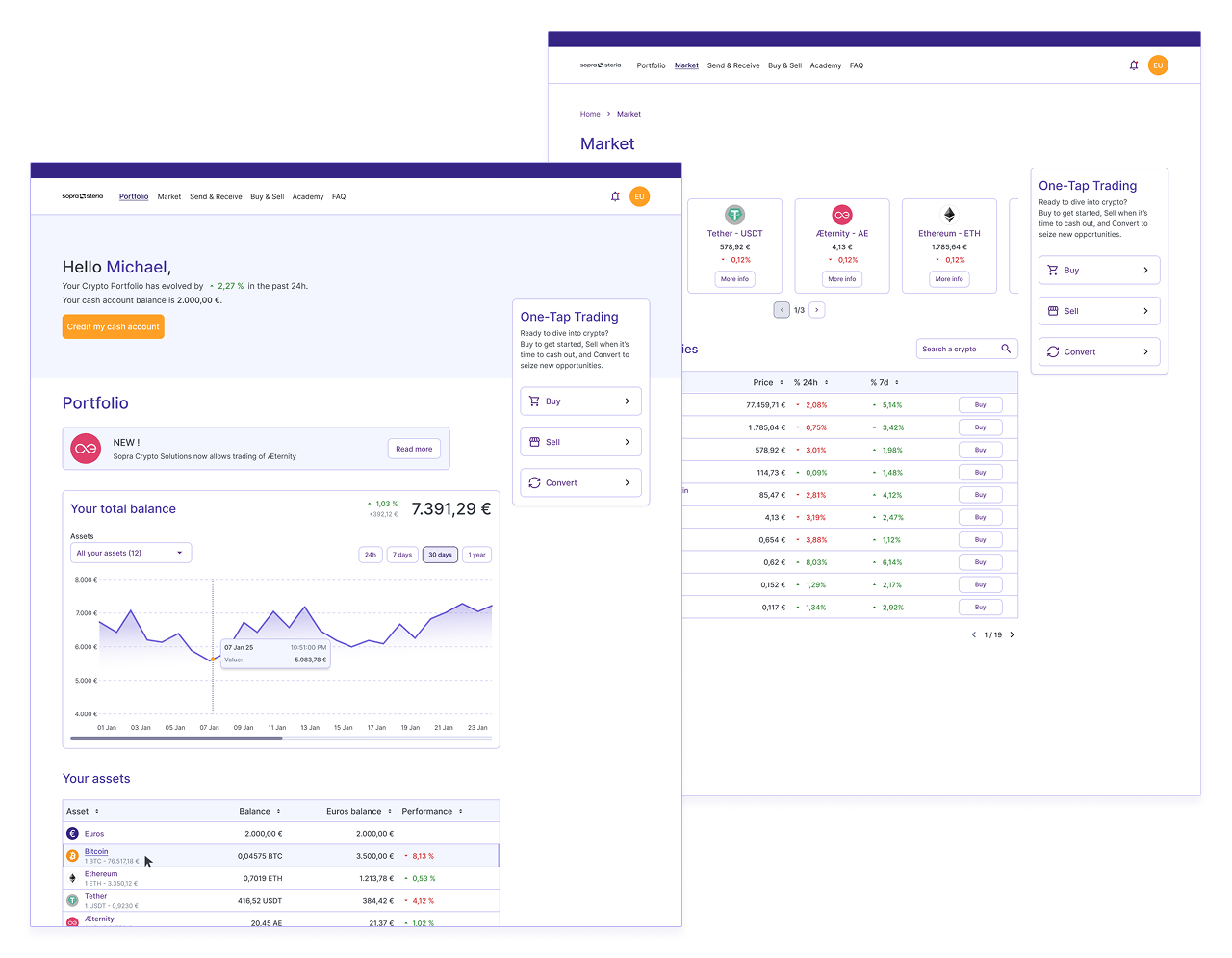

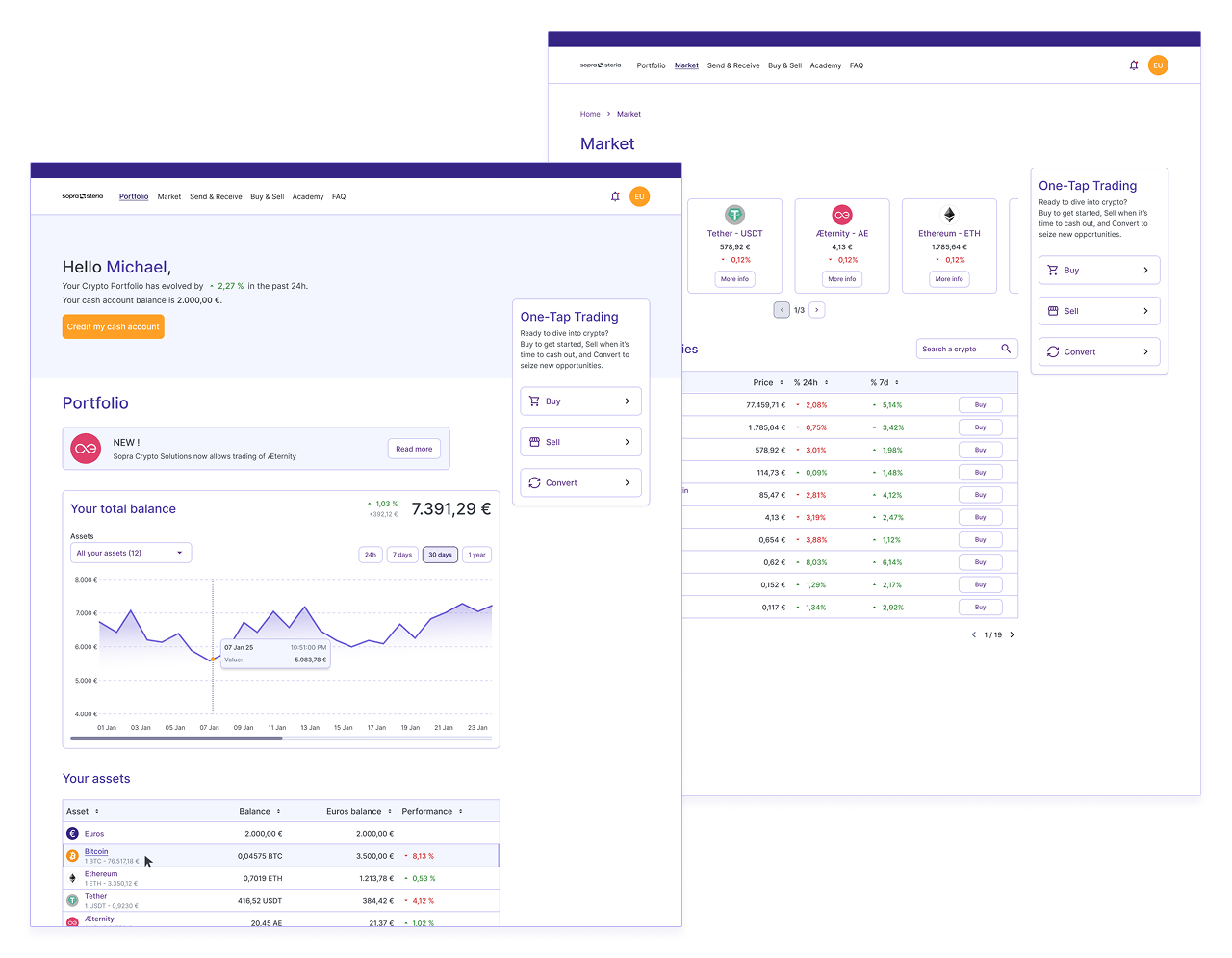

Design publications list (directly on page or in a section)

Sopra Steria enables Banks to enter the Crypto-Asset market with a complete and tailor-made offer

Apr 23, 2025, 11:24 AM

Title* :

Sopra Steria enables Banks to enter the Crypto-Asset market with a complete and tailor-made offer

Sopra Steria,announces the launch of Sopra Crypto Solutions, a comprehensive white-label offering designed to accelerate the adoption of crypto-assets by banks.

- Sopra Steria is launching a comprehensive offering to support banks as they launch crypto-asset-related offerings, leveraging strategic assets with Fireblocks, Chainalysis and Wyden to ensure security, compliance and access to liquidity.

- The solution offers seamless integration into the banking environment, advanced security and compliance with specific regulations in place, such as MiCA and TFR, with accelerated deployment in just 6 months.

Explore Sopra Crypto Solutions

Paris, 23 April 2025 - Sopra Steria, a major player in European tech, announces the launch of Sopra Crypto Solutions, a comprehensive white-label offering designed to accelerate the adoption of crypto-assets by banks. This solution is built on three technological assets with Fireblocks (secure digital asset management), Chainalysis (compliance) and Wyden (order execution and trade management), offering an integrated response to regulatory and operational challenges.

Faced with growing consumer demand and the emergence of new financial technologies, banks today have to respond to an increasingly pressing need: to offer their customers crypto solutions.

“ With the entry into force of the European MiCA regulatory framework, banks finally have clear visibility to integrate crypto-assets in a structured way. Our offering meets a dual imperative: securing flows while delivering maximum value to the end customer. The adoption of cryptos is now a must, and a strategic lever for attracting the younger generation and maintaining competitiveness in tomorrow's financial ecosystem," comments Grégory Wintrebert, CEO of Group Vertical Financial Services, Sopra Steria.

An integrated solution for managing crypto-assets with full compliance

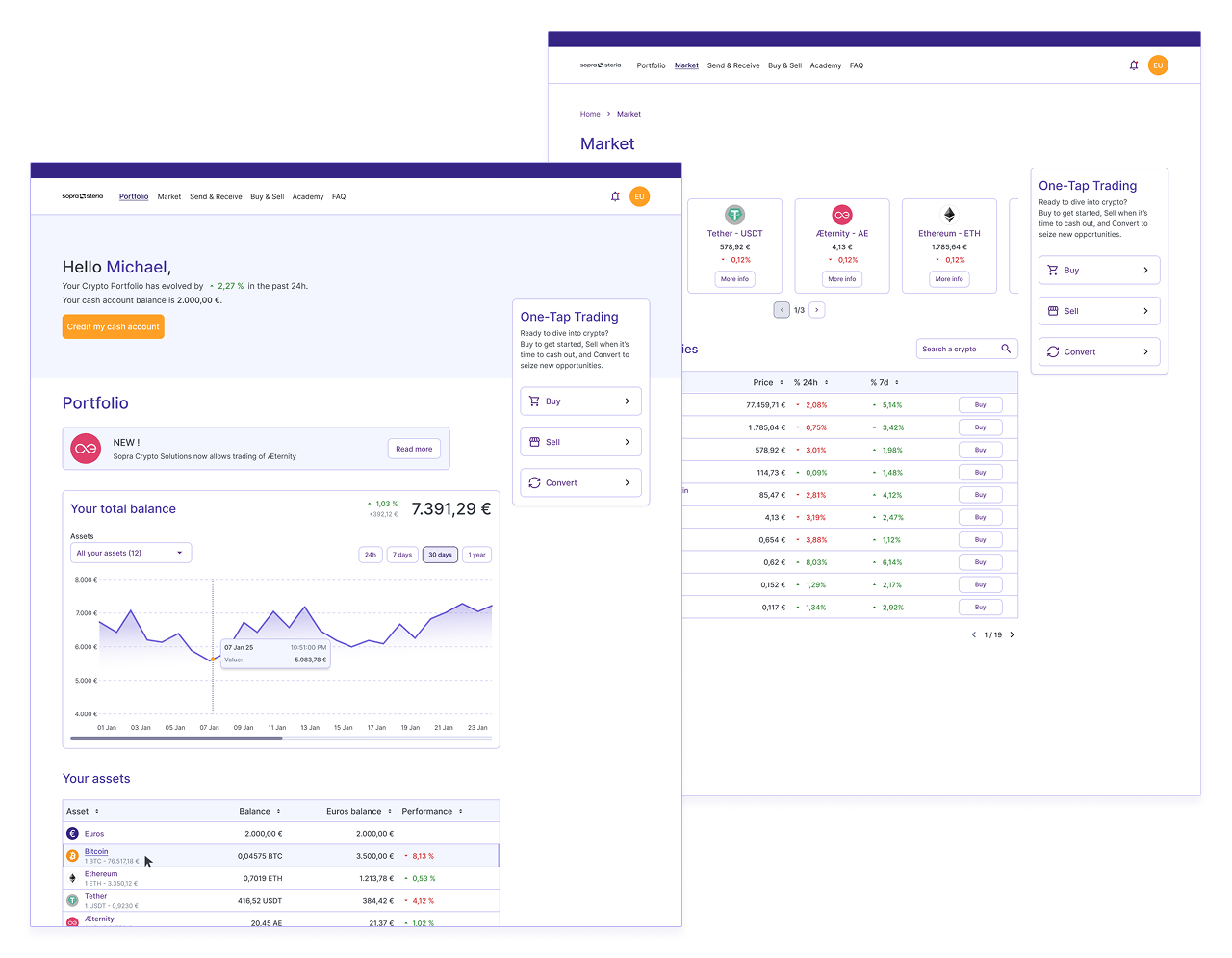

Sopra Crypto Solutions enables banks to offer their customers the purchase, sale and storage of crypto-assets. The solution reduces time-to-market in order to meet growing user demand and keep banks competitive.

The platform offers an end-to-end solution incorporating :

- APIs compatible with existing banking systems for fast, seamless integration.

- Cutting-edge functionalities guaranteeing the security of the crypto-assets held by the bank, with management and governance in the hands of the banks.

- Tools for compliance with various regulations (MICA, TFR) including measures such as automatic monitoring and blocking of risky transactions, automated account freezing in the event of suspicious activity, two-factor authentication and individually configurable transaction limits.

- Easy configuration of offers, user groups, volume limits, available crypto-assets and fee policy.

- Tools for optimising, monitoring and reporting activities.

- APIs enabling banks to design their own user experience or opt for a ready-to-use interface that is intuitive for novices.

- Dedicated dashboards for bank advisers and compliance officers simplify transaction management.

Comprehensive support

In addition to the platform, Sopra Steria offers its expertise in consulting and integration, enabling deployment in less than 6 months compared with 2 to 3 years for in-house development. The range of expertise covers both technological aspects, enabling Sopra Steria to work on all types of projects

"Sopra Crypto Solutions enables banks to meet two key challenges: ensuring the security and compliance of their customers' transactions, while offering a fluid and intuitive experience. Designed to meet market expectations, our solution guarantees secure management of digital assets, regulatory compliance, efficient customer support, easy access to liquidity and simplified financial reporting and tax declarations for users," explains Alexandre Eich Gozzi, Head of Product Management Financial Services, Sopra Steria.

Explore Sopra Crypto Solutions

/crypto-page.jpg?sfvrsn=87523db_1)

Design list cards (directly on page or in a section)

Sopra Steria enables Banks to enter the Crypto-Asset market with a complete and tailor-made offer

Apr 23, 2025, 11:24 AM

Title* :

Sopra Steria enables Banks to enter the Crypto-Asset market with a complete and tailor-made offer

Sopra Steria,announces the launch of Sopra Crypto Solutions, a comprehensive white-label offering designed to accelerate the adoption of crypto-assets by banks.

- Sopra Steria is launching a comprehensive offering to support banks as they launch crypto-asset-related offerings, leveraging strategic assets with Fireblocks, Chainalysis and Wyden to ensure security, compliance and access to liquidity.

- The solution offers seamless integration into the banking environment, advanced security and compliance with specific regulations in place, such as MiCA and TFR, with accelerated deployment in just 6 months.

Explore Sopra Crypto Solutions

Paris, 23 April 2025 - Sopra Steria, a major player in European tech, announces the launch of Sopra Crypto Solutions, a comprehensive white-label offering designed to accelerate the adoption of crypto-assets by banks. This solution is built on three technological assets with Fireblocks (secure digital asset management), Chainalysis (compliance) and Wyden (order execution and trade management), offering an integrated response to regulatory and operational challenges.

Faced with growing consumer demand and the emergence of new financial technologies, banks today have to respond to an increasingly pressing need: to offer their customers crypto solutions.

“ With the entry into force of the European MiCA regulatory framework, banks finally have clear visibility to integrate crypto-assets in a structured way. Our offering meets a dual imperative: securing flows while delivering maximum value to the end customer. The adoption of cryptos is now a must, and a strategic lever for attracting the younger generation and maintaining competitiveness in tomorrow's financial ecosystem," comments Grégory Wintrebert, CEO of Group Vertical Financial Services, Sopra Steria.

An integrated solution for managing crypto-assets with full compliance

Sopra Crypto Solutions enables banks to offer their customers the purchase, sale and storage of crypto-assets. The solution reduces time-to-market in order to meet growing user demand and keep banks competitive.

The platform offers an end-to-end solution incorporating :

- APIs compatible with existing banking systems for fast, seamless integration.

- Cutting-edge functionalities guaranteeing the security of the crypto-assets held by the bank, with management and governance in the hands of the banks.

- Tools for compliance with various regulations (MICA, TFR) including measures such as automatic monitoring and blocking of risky transactions, automated account freezing in the event of suspicious activity, two-factor authentication and individually configurable transaction limits.

- Easy configuration of offers, user groups, volume limits, available crypto-assets and fee policy.

- Tools for optimising, monitoring and reporting activities.

- APIs enabling banks to design their own user experience or opt for a ready-to-use interface that is intuitive for novices.

- Dedicated dashboards for bank advisers and compliance officers simplify transaction management.

Comprehensive support

In addition to the platform, Sopra Steria offers its expertise in consulting and integration, enabling deployment in less than 6 months compared with 2 to 3 years for in-house development. The range of expertise covers both technological aspects, enabling Sopra Steria to work on all types of projects

"Sopra Crypto Solutions enables banks to meet two key challenges: ensuring the security and compliance of their customers' transactions, while offering a fluid and intuitive experience. Designed to meet market expectations, our solution guarantees secure management of digital assets, regulatory compliance, efficient customer support, easy access to liquidity and simplified financial reporting and tax declarations for users," explains Alexandre Eich Gozzi, Head of Product Management Financial Services, Sopra Steria.

Explore Sopra Crypto Solutions

/crypto-page.jpg?sfvrsn=87523db_1)

Design list cards filtered (directly on page, is a section)

Sopra Steria enables Banks to enter the Crypto-Asset market with a complete and tailor-made offer

Apr 23, 2025, 11:24 AM

Title* :

Sopra Steria enables Banks to enter the Crypto-Asset market with a complete and tailor-made offer

Sopra Steria,announces the launch of Sopra Crypto Solutions, a comprehensive white-label offering designed to accelerate the adoption of crypto-assets by banks.

- Sopra Steria is launching a comprehensive offering to support banks as they launch crypto-asset-related offerings, leveraging strategic assets with Fireblocks, Chainalysis and Wyden to ensure security, compliance and access to liquidity.

- The solution offers seamless integration into the banking environment, advanced security and compliance with specific regulations in place, such as MiCA and TFR, with accelerated deployment in just 6 months.

Explore Sopra Crypto Solutions

Paris, 23 April 2025 - Sopra Steria, a major player in European tech, announces the launch of Sopra Crypto Solutions, a comprehensive white-label offering designed to accelerate the adoption of crypto-assets by banks. This solution is built on three technological assets with Fireblocks (secure digital asset management), Chainalysis (compliance) and Wyden (order execution and trade management), offering an integrated response to regulatory and operational challenges.

Faced with growing consumer demand and the emergence of new financial technologies, banks today have to respond to an increasingly pressing need: to offer their customers crypto solutions.

“ With the entry into force of the European MiCA regulatory framework, banks finally have clear visibility to integrate crypto-assets in a structured way. Our offering meets a dual imperative: securing flows while delivering maximum value to the end customer. The adoption of cryptos is now a must, and a strategic lever for attracting the younger generation and maintaining competitiveness in tomorrow's financial ecosystem," comments Grégory Wintrebert, CEO of Group Vertical Financial Services, Sopra Steria.

An integrated solution for managing crypto-assets with full compliance

Sopra Crypto Solutions enables banks to offer their customers the purchase, sale and storage of crypto-assets. The solution reduces time-to-market in order to meet growing user demand and keep banks competitive.

The platform offers an end-to-end solution incorporating :

- APIs compatible with existing banking systems for fast, seamless integration.

- Cutting-edge functionalities guaranteeing the security of the crypto-assets held by the bank, with management and governance in the hands of the banks.

- Tools for compliance with various regulations (MICA, TFR) including measures such as automatic monitoring and blocking of risky transactions, automated account freezing in the event of suspicious activity, two-factor authentication and individually configurable transaction limits.

- Easy configuration of offers, user groups, volume limits, available crypto-assets and fee policy.

- Tools for optimising, monitoring and reporting activities.

- APIs enabling banks to design their own user experience or opt for a ready-to-use interface that is intuitive for novices.

- Dedicated dashboards for bank advisers and compliance officers simplify transaction management.

Comprehensive support

In addition to the platform, Sopra Steria offers its expertise in consulting and integration, enabling deployment in less than 6 months compared with 2 to 3 years for in-house development. The range of expertise covers both technological aspects, enabling Sopra Steria to work on all types of projects

"Sopra Crypto Solutions enables banks to meet two key challenges: ensuring the security and compliance of their customers' transactions, while offering a fluid and intuitive experience. Designed to meet market expectations, our solution guarantees secure management of digital assets, regulatory compliance, efficient customer support, easy access to liquidity and simplified financial reporting and tax declarations for users," explains Alexandre Eich Gozzi, Head of Product Management Financial Services, Sopra Steria.

Explore Sopra Crypto Solutions

/crypto-page.jpg?sfvrsn=87523db_1)

Design list cards filtered (directly on page, is a section)

Sopra Steria enables Banks to enter the Crypto-Asset market with a complete and tailor-made offer

Apr 23, 2025, 11:24 AM

Title* :

Sopra Steria enables Banks to enter the Crypto-Asset market with a complete and tailor-made offer

Sopra Steria,announces the launch of Sopra Crypto Solutions, a comprehensive white-label offering designed to accelerate the adoption of crypto-assets by banks.

- Sopra Steria is launching a comprehensive offering to support banks as they launch crypto-asset-related offerings, leveraging strategic assets with Fireblocks, Chainalysis and Wyden to ensure security, compliance and access to liquidity.

- The solution offers seamless integration into the banking environment, advanced security and compliance with specific regulations in place, such as MiCA and TFR, with accelerated deployment in just 6 months.

Explore Sopra Crypto Solutions

Paris, 23 April 2025 - Sopra Steria, a major player in European tech, announces the launch of Sopra Crypto Solutions, a comprehensive white-label offering designed to accelerate the adoption of crypto-assets by banks. This solution is built on three technological assets with Fireblocks (secure digital asset management), Chainalysis (compliance) and Wyden (order execution and trade management), offering an integrated response to regulatory and operational challenges.

Faced with growing consumer demand and the emergence of new financial technologies, banks today have to respond to an increasingly pressing need: to offer their customers crypto solutions.

“ With the entry into force of the European MiCA regulatory framework, banks finally have clear visibility to integrate crypto-assets in a structured way. Our offering meets a dual imperative: securing flows while delivering maximum value to the end customer. The adoption of cryptos is now a must, and a strategic lever for attracting the younger generation and maintaining competitiveness in tomorrow's financial ecosystem," comments Grégory Wintrebert, CEO of Group Vertical Financial Services, Sopra Steria.

An integrated solution for managing crypto-assets with full compliance

Sopra Crypto Solutions enables banks to offer their customers the purchase, sale and storage of crypto-assets. The solution reduces time-to-market in order to meet growing user demand and keep banks competitive.

The platform offers an end-to-end solution incorporating :

- APIs compatible with existing banking systems for fast, seamless integration.

- Cutting-edge functionalities guaranteeing the security of the crypto-assets held by the bank, with management and governance in the hands of the banks.

- Tools for compliance with various regulations (MICA, TFR) including measures such as automatic monitoring and blocking of risky transactions, automated account freezing in the event of suspicious activity, two-factor authentication and individually configurable transaction limits.

- Easy configuration of offers, user groups, volume limits, available crypto-assets and fee policy.

- Tools for optimising, monitoring and reporting activities.

- APIs enabling banks to design their own user experience or opt for a ready-to-use interface that is intuitive for novices.

- Dedicated dashboards for bank advisers and compliance officers simplify transaction management.

Comprehensive support

In addition to the platform, Sopra Steria offers its expertise in consulting and integration, enabling deployment in less than 6 months compared with 2 to 3 years for in-house development. The range of expertise covers both technological aspects, enabling Sopra Steria to work on all types of projects

"Sopra Crypto Solutions enables banks to meet two key challenges: ensuring the security and compliance of their customers' transactions, while offering a fluid and intuitive experience. Designed to meet market expectations, our solution guarantees secure management of digital assets, regulatory compliance, efficient customer support, easy access to liquidity and simplified financial reporting and tax declarations for users," explains Alexandre Eich Gozzi, Head of Product Management Financial Services, Sopra Steria.

Explore Sopra Crypto Solutions

/crypto-page.jpg?sfvrsn=87523db_1)

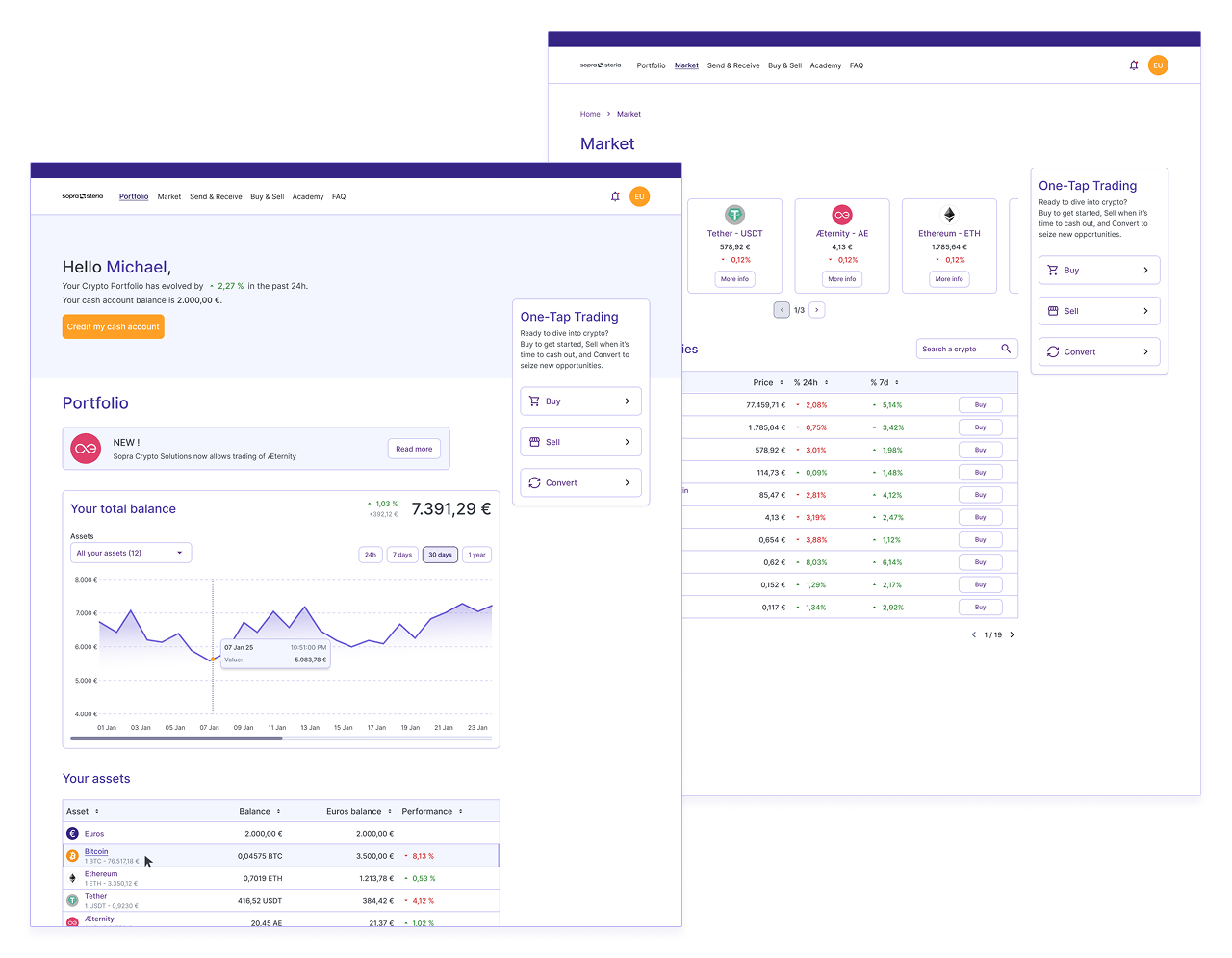

Design single article vertical (in a grid-x2 or grid-x3)

Sopra Steria enables Banks to enter the Crypto-Asset market with a complete and tailor-made offer

Apr 23, 2025, 11:24 AM

Title* :

Sopra Steria enables Banks to enter the Crypto-Asset market with a complete and tailor-made offer

Sopra Steria,announces the launch of Sopra Crypto Solutions, a comprehensive white-label offering designed to accelerate the adoption of crypto-assets by banks.

- Sopra Steria is launching a comprehensive offering to support banks as they launch crypto-asset-related offerings, leveraging strategic assets with Fireblocks, Chainalysis and Wyden to ensure security, compliance and access to liquidity.

- The solution offers seamless integration into the banking environment, advanced security and compliance with specific regulations in place, such as MiCA and TFR, with accelerated deployment in just 6 months.

Explore Sopra Crypto Solutions

Paris, 23 April 2025 - Sopra Steria, a major player in European tech, announces the launch of Sopra Crypto Solutions, a comprehensive white-label offering designed to accelerate the adoption of crypto-assets by banks. This solution is built on three technological assets with Fireblocks (secure digital asset management), Chainalysis (compliance) and Wyden (order execution and trade management), offering an integrated response to regulatory and operational challenges.

Faced with growing consumer demand and the emergence of new financial technologies, banks today have to respond to an increasingly pressing need: to offer their customers crypto solutions.

“ With the entry into force of the European MiCA regulatory framework, banks finally have clear visibility to integrate crypto-assets in a structured way. Our offering meets a dual imperative: securing flows while delivering maximum value to the end customer. The adoption of cryptos is now a must, and a strategic lever for attracting the younger generation and maintaining competitiveness in tomorrow's financial ecosystem," comments Grégory Wintrebert, CEO of Group Vertical Financial Services, Sopra Steria.

An integrated solution for managing crypto-assets with full compliance

Sopra Crypto Solutions enables banks to offer their customers the purchase, sale and storage of crypto-assets. The solution reduces time-to-market in order to meet growing user demand and keep banks competitive.

The platform offers an end-to-end solution incorporating :

- APIs compatible with existing banking systems for fast, seamless integration.

- Cutting-edge functionalities guaranteeing the security of the crypto-assets held by the bank, with management and governance in the hands of the banks.

- Tools for compliance with various regulations (MICA, TFR) including measures such as automatic monitoring and blocking of risky transactions, automated account freezing in the event of suspicious activity, two-factor authentication and individually configurable transaction limits.

- Easy configuration of offers, user groups, volume limits, available crypto-assets and fee policy.

- Tools for optimising, monitoring and reporting activities.

- APIs enabling banks to design their own user experience or opt for a ready-to-use interface that is intuitive for novices.

- Dedicated dashboards for bank advisers and compliance officers simplify transaction management.

Comprehensive support

In addition to the platform, Sopra Steria offers its expertise in consulting and integration, enabling deployment in less than 6 months compared with 2 to 3 years for in-house development. The range of expertise covers both technological aspects, enabling Sopra Steria to work on all types of projects

"Sopra Crypto Solutions enables banks to meet two key challenges: ensuring the security and compliance of their customers' transactions, while offering a fluid and intuitive experience. Designed to meet market expectations, our solution guarantees secure management of digital assets, regulatory compliance, efficient customer support, easy access to liquidity and simplified financial reporting and tax declarations for users," explains Alexandre Eich Gozzi, Head of Product Management Financial Services, Sopra Steria.

Explore Sopra Crypto Solutions

/crypto-page.jpg?sfvrsn=87523db_1)

Design horizontal overlay imgLeft (directly on page or in a section)

Sopra Steria enables Banks to enter the Crypto-Asset market with a complete and tailor-made offer

Apr 23, 2025, 11:24 AM

Title* :

Sopra Steria enables Banks to enter the Crypto-Asset market with a complete and tailor-made offer

Sopra Steria,announces the launch of Sopra Crypto Solutions, a comprehensive white-label offering designed to accelerate the adoption of crypto-assets by banks.

- Sopra Steria is launching a comprehensive offering to support banks as they launch crypto-asset-related offerings, leveraging strategic assets with Fireblocks, Chainalysis and Wyden to ensure security, compliance and access to liquidity.

- The solution offers seamless integration into the banking environment, advanced security and compliance with specific regulations in place, such as MiCA and TFR, with accelerated deployment in just 6 months.

Explore Sopra Crypto Solutions

Paris, 23 April 2025 - Sopra Steria, a major player in European tech, announces the launch of Sopra Crypto Solutions, a comprehensive white-label offering designed to accelerate the adoption of crypto-assets by banks. This solution is built on three technological assets with Fireblocks (secure digital asset management), Chainalysis (compliance) and Wyden (order execution and trade management), offering an integrated response to regulatory and operational challenges.

Faced with growing consumer demand and the emergence of new financial technologies, banks today have to respond to an increasingly pressing need: to offer their customers crypto solutions.

“ With the entry into force of the European MiCA regulatory framework, banks finally have clear visibility to integrate crypto-assets in a structured way. Our offering meets a dual imperative: securing flows while delivering maximum value to the end customer. The adoption of cryptos is now a must, and a strategic lever for attracting the younger generation and maintaining competitiveness in tomorrow's financial ecosystem," comments Grégory Wintrebert, CEO of Group Vertical Financial Services, Sopra Steria.

An integrated solution for managing crypto-assets with full compliance

Sopra Crypto Solutions enables banks to offer their customers the purchase, sale and storage of crypto-assets. The solution reduces time-to-market in order to meet growing user demand and keep banks competitive.

The platform offers an end-to-end solution incorporating :

- APIs compatible with existing banking systems for fast, seamless integration.

- Cutting-edge functionalities guaranteeing the security of the crypto-assets held by the bank, with management and governance in the hands of the banks.

- Tools for compliance with various regulations (MICA, TFR) including measures such as automatic monitoring and blocking of risky transactions, automated account freezing in the event of suspicious activity, two-factor authentication and individually configurable transaction limits.

- Easy configuration of offers, user groups, volume limits, available crypto-assets and fee policy.

- Tools for optimising, monitoring and reporting activities.

- APIs enabling banks to design their own user experience or opt for a ready-to-use interface that is intuitive for novices.

- Dedicated dashboards for bank advisers and compliance officers simplify transaction management.

Comprehensive support

In addition to the platform, Sopra Steria offers its expertise in consulting and integration, enabling deployment in less than 6 months compared with 2 to 3 years for in-house development. The range of expertise covers both technological aspects, enabling Sopra Steria to work on all types of projects

"Sopra Crypto Solutions enables banks to meet two key challenges: ensuring the security and compliance of their customers' transactions, while offering a fluid and intuitive experience. Designed to meet market expectations, our solution guarantees secure management of digital assets, regulatory compliance, efficient customer support, easy access to liquidity and simplified financial reporting and tax declarations for users," explains Alexandre Eich Gozzi, Head of Product Management Financial Services, Sopra Steria.

Explore Sopra Crypto Solutions

/crypto-page.jpg?sfvrsn=87523db_1)

Design horizontal overlay imgLeft (directly on page or in a section)

Sopra Steria enables Banks to enter the Crypto-Asset market with a complete and tailor-made offer

Apr 23, 2025, 11:24 AM

Title* :

Sopra Steria enables Banks to enter the Crypto-Asset market with a complete and tailor-made offer

Sopra Steria,announces the launch of Sopra Crypto Solutions, a comprehensive white-label offering designed to accelerate the adoption of crypto-assets by banks.

- Sopra Steria is launching a comprehensive offering to support banks as they launch crypto-asset-related offerings, leveraging strategic assets with Fireblocks, Chainalysis and Wyden to ensure security, compliance and access to liquidity.

- The solution offers seamless integration into the banking environment, advanced security and compliance with specific regulations in place, such as MiCA and TFR, with accelerated deployment in just 6 months.

Explore Sopra Crypto Solutions

Paris, 23 April 2025 - Sopra Steria, a major player in European tech, announces the launch of Sopra Crypto Solutions, a comprehensive white-label offering designed to accelerate the adoption of crypto-assets by banks. This solution is built on three technological assets with Fireblocks (secure digital asset management), Chainalysis (compliance) and Wyden (order execution and trade management), offering an integrated response to regulatory and operational challenges.

Faced with growing consumer demand and the emergence of new financial technologies, banks today have to respond to an increasingly pressing need: to offer their customers crypto solutions.

“ With the entry into force of the European MiCA regulatory framework, banks finally have clear visibility to integrate crypto-assets in a structured way. Our offering meets a dual imperative: securing flows while delivering maximum value to the end customer. The adoption of cryptos is now a must, and a strategic lever for attracting the younger generation and maintaining competitiveness in tomorrow's financial ecosystem," comments Grégory Wintrebert, CEO of Group Vertical Financial Services, Sopra Steria.

An integrated solution for managing crypto-assets with full compliance

Sopra Crypto Solutions enables banks to offer their customers the purchase, sale and storage of crypto-assets. The solution reduces time-to-market in order to meet growing user demand and keep banks competitive.

The platform offers an end-to-end solution incorporating :

- APIs compatible with existing banking systems for fast, seamless integration.

- Cutting-edge functionalities guaranteeing the security of the crypto-assets held by the bank, with management and governance in the hands of the banks.

- Tools for compliance with various regulations (MICA, TFR) including measures such as automatic monitoring and blocking of risky transactions, automated account freezing in the event of suspicious activity, two-factor authentication and individually configurable transaction limits.

- Easy configuration of offers, user groups, volume limits, available crypto-assets and fee policy.

- Tools for optimising, monitoring and reporting activities.

- APIs enabling banks to design their own user experience or opt for a ready-to-use interface that is intuitive for novices.

- Dedicated dashboards for bank advisers and compliance officers simplify transaction management.

Comprehensive support

In addition to the platform, Sopra Steria offers its expertise in consulting and integration, enabling deployment in less than 6 months compared with 2 to 3 years for in-house development. The range of expertise covers both technological aspects, enabling Sopra Steria to work on all types of projects

"Sopra Crypto Solutions enables banks to meet two key challenges: ensuring the security and compliance of their customers' transactions, while offering a fluid and intuitive experience. Designed to meet market expectations, our solution guarantees secure management of digital assets, regulatory compliance, efficient customer support, easy access to liquidity and simplified financial reporting and tax declarations for users," explains Alexandre Eich Gozzi, Head of Product Management Financial Services, Sopra Steria.

Explore Sopra Crypto Solutions

/crypto-page.jpg?sfvrsn=87523db_1)

Design horizontal imgLeft (directly on page or in a section)

Sopra Steria enables Banks to enter the Crypto-Asset market with a complete and tailor-made offer

Apr 23, 2025, 11:24 AM

Title* :

Sopra Steria enables Banks to enter the Crypto-Asset market with a complete and tailor-made offer

Sopra Steria,announces the launch of Sopra Crypto Solutions, a comprehensive white-label offering designed to accelerate the adoption of crypto-assets by banks.

- Sopra Steria is launching a comprehensive offering to support banks as they launch crypto-asset-related offerings, leveraging strategic assets with Fireblocks, Chainalysis and Wyden to ensure security, compliance and access to liquidity.

- The solution offers seamless integration into the banking environment, advanced security and compliance with specific regulations in place, such as MiCA and TFR, with accelerated deployment in just 6 months.

Explore Sopra Crypto Solutions

Paris, 23 April 2025 - Sopra Steria, a major player in European tech, announces the launch of Sopra Crypto Solutions, a comprehensive white-label offering designed to accelerate the adoption of crypto-assets by banks. This solution is built on three technological assets with Fireblocks (secure digital asset management), Chainalysis (compliance) and Wyden (order execution and trade management), offering an integrated response to regulatory and operational challenges.

Faced with growing consumer demand and the emergence of new financial technologies, banks today have to respond to an increasingly pressing need: to offer their customers crypto solutions.

“ With the entry into force of the European MiCA regulatory framework, banks finally have clear visibility to integrate crypto-assets in a structured way. Our offering meets a dual imperative: securing flows while delivering maximum value to the end customer. The adoption of cryptos is now a must, and a strategic lever for attracting the younger generation and maintaining competitiveness in tomorrow's financial ecosystem," comments Grégory Wintrebert, CEO of Group Vertical Financial Services, Sopra Steria.

An integrated solution for managing crypto-assets with full compliance

Sopra Crypto Solutions enables banks to offer their customers the purchase, sale and storage of crypto-assets. The solution reduces time-to-market in order to meet growing user demand and keep banks competitive.

The platform offers an end-to-end solution incorporating :

- APIs compatible with existing banking systems for fast, seamless integration.

- Cutting-edge functionalities guaranteeing the security of the crypto-assets held by the bank, with management and governance in the hands of the banks.

- Tools for compliance with various regulations (MICA, TFR) including measures such as automatic monitoring and blocking of risky transactions, automated account freezing in the event of suspicious activity, two-factor authentication and individually configurable transaction limits.

- Easy configuration of offers, user groups, volume limits, available crypto-assets and fee policy.

- Tools for optimising, monitoring and reporting activities.

- APIs enabling banks to design their own user experience or opt for a ready-to-use interface that is intuitive for novices.

- Dedicated dashboards for bank advisers and compliance officers simplify transaction management.

Comprehensive support

In addition to the platform, Sopra Steria offers its expertise in consulting and integration, enabling deployment in less than 6 months compared with 2 to 3 years for in-house development. The range of expertise covers both technological aspects, enabling Sopra Steria to work on all types of projects

"Sopra Crypto Solutions enables banks to meet two key challenges: ensuring the security and compliance of their customers' transactions, while offering a fluid and intuitive experience. Designed to meet market expectations, our solution guarantees secure management of digital assets, regulatory compliance, efficient customer support, easy access to liquidity and simplified financial reporting and tax declarations for users," explains Alexandre Eich Gozzi, Head of Product Management Financial Services, Sopra Steria.

Explore Sopra Crypto Solutions

/crypto-page.jpg?sfvrsn=87523db_1)

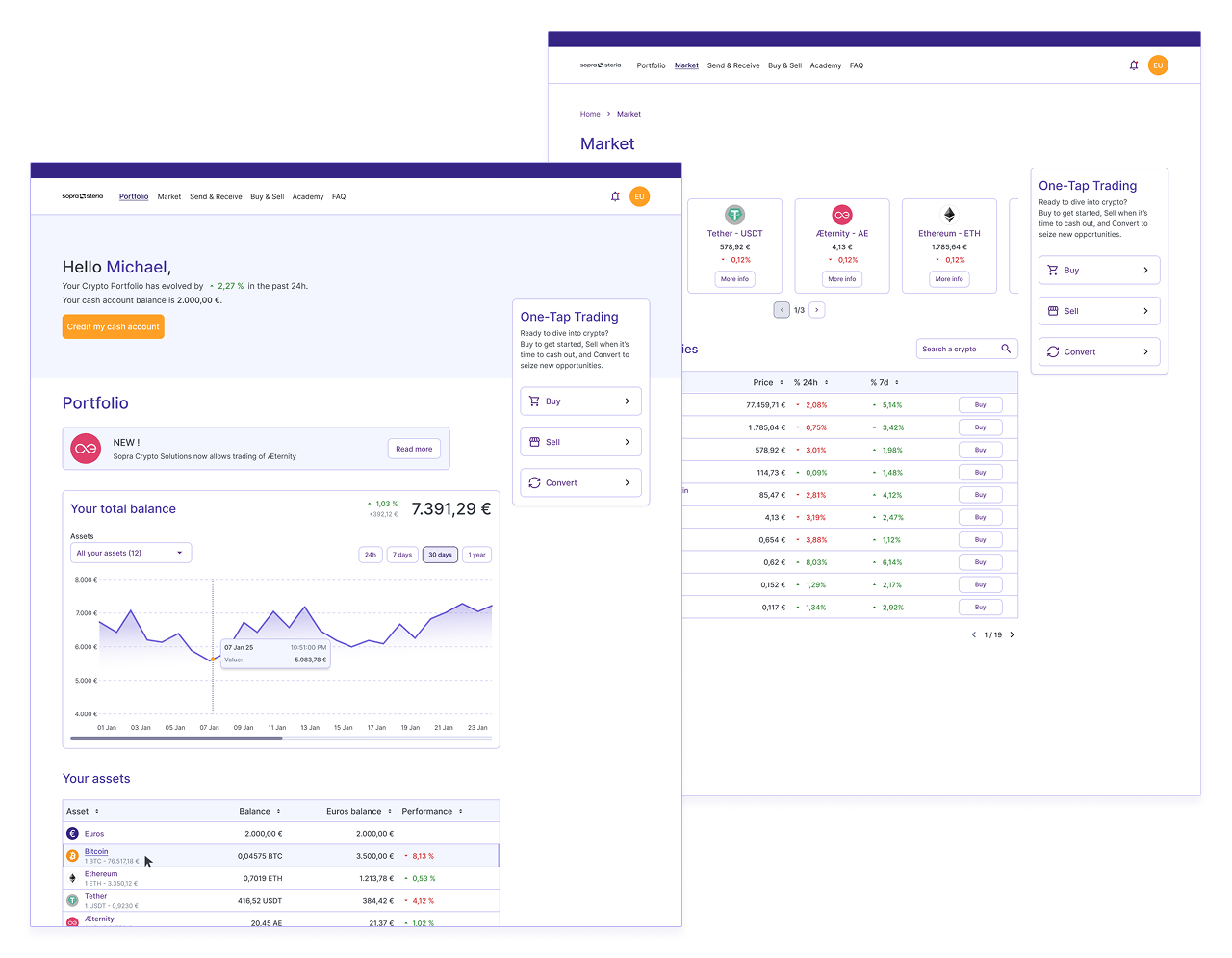

Design horizontal imgRight (directly on page or in a section)

Sopra Steria enables Banks to enter the Crypto-Asset market with a complete and tailor-made offer

Apr 23, 2025, 11:24 AM

Title* :

Sopra Steria enables Banks to enter the Crypto-Asset market with a complete and tailor-made offer

Sopra Steria,announces the launch of Sopra Crypto Solutions, a comprehensive white-label offering designed to accelerate the adoption of crypto-assets by banks.

- Sopra Steria is launching a comprehensive offering to support banks as they launch crypto-asset-related offerings, leveraging strategic assets with Fireblocks, Chainalysis and Wyden to ensure security, compliance and access to liquidity.

- The solution offers seamless integration into the banking environment, advanced security and compliance with specific regulations in place, such as MiCA and TFR, with accelerated deployment in just 6 months.

Explore Sopra Crypto Solutions

Paris, 23 April 2025 - Sopra Steria, a major player in European tech, announces the launch of Sopra Crypto Solutions, a comprehensive white-label offering designed to accelerate the adoption of crypto-assets by banks. This solution is built on three technological assets with Fireblocks (secure digital asset management), Chainalysis (compliance) and Wyden (order execution and trade management), offering an integrated response to regulatory and operational challenges.

Faced with growing consumer demand and the emergence of new financial technologies, banks today have to respond to an increasingly pressing need: to offer their customers crypto solutions.

“ With the entry into force of the European MiCA regulatory framework, banks finally have clear visibility to integrate crypto-assets in a structured way. Our offering meets a dual imperative: securing flows while delivering maximum value to the end customer. The adoption of cryptos is now a must, and a strategic lever for attracting the younger generation and maintaining competitiveness in tomorrow's financial ecosystem," comments Grégory Wintrebert, CEO of Group Vertical Financial Services, Sopra Steria.

An integrated solution for managing crypto-assets with full compliance

Sopra Crypto Solutions enables banks to offer their customers the purchase, sale and storage of crypto-assets. The solution reduces time-to-market in order to meet growing user demand and keep banks competitive.

The platform offers an end-to-end solution incorporating :

- APIs compatible with existing banking systems for fast, seamless integration.

- Cutting-edge functionalities guaranteeing the security of the crypto-assets held by the bank, with management and governance in the hands of the banks.

- Tools for compliance with various regulations (MICA, TFR) including measures such as automatic monitoring and blocking of risky transactions, automated account freezing in the event of suspicious activity, two-factor authentication and individually configurable transaction limits.

- Easy configuration of offers, user groups, volume limits, available crypto-assets and fee policy.

- Tools for optimising, monitoring and reporting activities.

- APIs enabling banks to design their own user experience or opt for a ready-to-use interface that is intuitive for novices.

- Dedicated dashboards for bank advisers and compliance officers simplify transaction management.

Comprehensive support

In addition to the platform, Sopra Steria offers its expertise in consulting and integration, enabling deployment in less than 6 months compared with 2 to 3 years for in-house development. The range of expertise covers both technological aspects, enabling Sopra Steria to work on all types of projects

"Sopra Crypto Solutions enables banks to meet two key challenges: ensuring the security and compliance of their customers' transactions, while offering a fluid and intuitive experience. Designed to meet market expectations, our solution guarantees secure management of digital assets, regulatory compliance, efficient customer support, easy access to liquidity and simplified financial reporting and tax declarations for users," explains Alexandre Eich Gozzi, Head of Product Management Financial Services, Sopra Steria.

Explore Sopra Crypto Solutions

/crypto-page.jpg?sfvrsn=87523db_1)

Design vie du titre filtrage

Design informations reglementees filtered

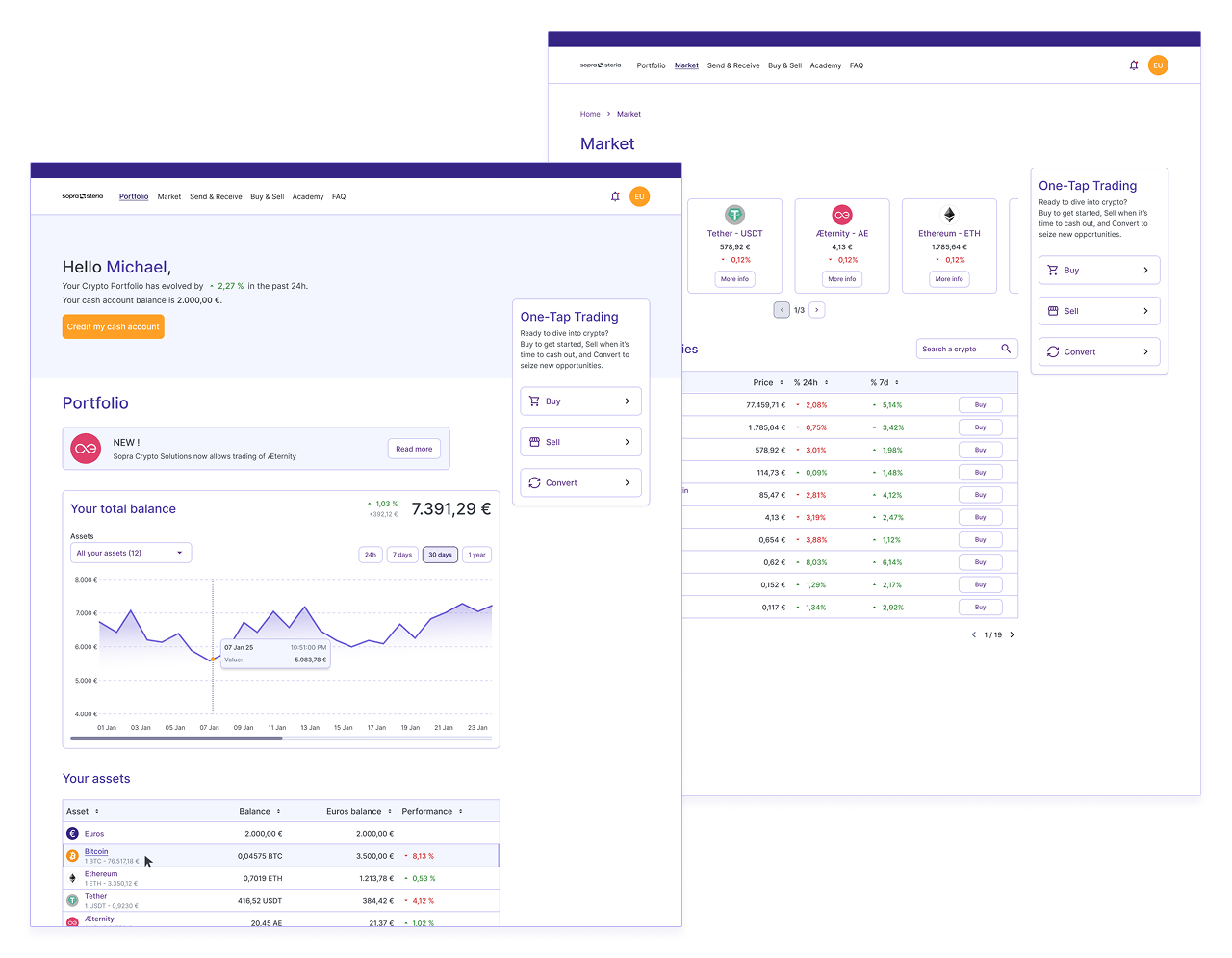

Sopra Steria enables Banks to enter the Crypto-Asset market with a complete and tailor-made offer

|

minute read

- Sopra Steria is launching a comprehensive offering to support banks as they launch crypto-asset-related offerings, leveraging strategic assets with Fireblocks, Chainalysis and Wyden to ensure security, compliance and access to liquidity.

- The solution offers seamless integration into the banking environment, advanced security and compliance with specific regulations in place, such as MiCA and TFR, with accelerated deployment in just 6 months.

Explore Sopra Crypto Solutions

Paris, 23 April 2025 - Sopra Steria, a major player in European tech, announces the launch of Sopra Crypto Solutions, a comprehensive white-label offering designed to accelerate the adoption of crypto-assets by banks. This solution is built on three technological assets with Fireblocks (secure digital asset management), Chainalysis (compliance) and Wyden (order execution and trade management), offering an integrated response to regulatory and operational challenges.

Faced with growing consumer demand and the emergence of new financial technologies, banks today have to respond to an increasingly pressing need: to offer their customers crypto solutions.

“ With the entry into force of the European MiCA regulatory framework, banks finally have clear visibility to integrate crypto-assets in a structured way. Our offering meets a dual imperative: securing flows while delivering maximum value to the end customer. The adoption of cryptos is now a must, and a strategic lever for attracting the younger generation and maintaining competitiveness in tomorrow's financial ecosystem," comments Grégory Wintrebert, CEO of Group Vertical Financial Services, Sopra Steria.

An integrated solution for managing crypto-assets with full compliance

Sopra Crypto Solutions enables banks to offer their customers the purchase, sale and storage of crypto-assets. The solution reduces time-to-market in order to meet growing user demand and keep banks competitive.

The platform offers an end-to-end solution incorporating :

- APIs compatible with existing banking systems for fast, seamless integration.

- Cutting-edge functionalities guaranteeing the security of the crypto-assets held by the bank, with management and governance in the hands of the banks.

- Tools for compliance with various regulations (MICA, TFR) including measures such as automatic monitoring and blocking of risky transactions, automated account freezing in the event of suspicious activity, two-factor authentication and individually configurable transaction limits.

- Easy configuration of offers, user groups, volume limits, available crypto-assets and fee policy.

- Tools for optimising, monitoring and reporting activities.

- APIs enabling banks to design their own user experience or opt for a ready-to-use interface that is intuitive for novices.

- Dedicated dashboards for bank advisers and compliance officers simplify transaction management.

Comprehensive support

In addition to the platform, Sopra Steria offers its expertise in consulting and integration, enabling deployment in less than 6 months compared with 2 to 3 years for in-house development. The range of expertise covers both technological aspects, enabling Sopra Steria to work on all types of projects

"Sopra Crypto Solutions enables banks to meet two key challenges: ensuring the security and compliance of their customers' transactions, while offering a fluid and intuitive experience. Designed to meet market expectations, our solution guarantees secure management of digital assets, regulatory compliance, efficient customer support, easy access to liquidity and simplified financial reporting and tax declarations for users," explains Alexandre Eich Gozzi, Head of Product Management Financial Services, Sopra Steria.

Explore Sopra Crypto Solutions

Incorporating AI into Iberpay’s fraud prevention tool Payguard has improved fraud detection and payment efficiency across Spain and beyond

TradSNCF, rail operator SNCF’s AI-powered translation tool, enhances the travel experience for millions of passengers from around the world.

A joint Norad-Sopra Steria project leverages AI and cloud tech to boost child literacy by creating open, accessible education resources.

Design block single article horizontal will be replaced by Design horizontal imgLeft.